Major Tax Changes Could Threaten Live Music Venues Across the UK

The recent budget announcement regarding tax changes may lead to significant repercussions for live music venues in the UK, according to trade bodies representing nearly 1,000 sites. With warnings of widespread closures and job losses, industry advocates are urgently calling for a reassessment of the chancellor’s alterations to the business rates system.

Why It Matters

These tax modifications pose serious threats not only to the survival of grassroots music venues but also to the larger creative sector, potentially impacting local economies and cultural landscapes. As venues brace for the ripple effects, questions arise about the sustainability of the live music industry in the face of escalating operational costs.

Key Developments

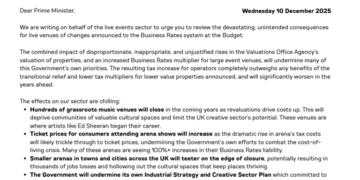

- Trade bodies, including groups representing major arenas and grassroots venues, have called for an urgent review of the chancellor’s business rates changes.

- They warn that hundreds of venues could close, leading to increased ticket prices and job losses.

- The business rates, levied on commercial properties, are determined by property value estimations, which have surged dramatically.

- Despite promises of lower tax burdens for small businesses, many have witnessed significant increases in their assessed property values, negating any anticipated benefits.

- Recommendations include an immediate 40% discount on business rates for live music venues and reforms to the property valuation system.

Full Report

Findings from Industry Leaders

In a unified letter coordinated by Live, prominent trade organizations are expressing grave concerns about the chilling effects of the budget changes. They claim that the increasing costs from the reevaluation of properties could lead to the closure of numerous grassroots venues that are vital to nurturing emerging talent. “This will deprive communities of valuable cultural spaces and limit the UK creative sector’s potential,” the letter states.

Economic Implications

As rising costs affect arena spaces, ticket prices for concerts and events are projected to climb as well. This price increase undermines governmental efforts aimed at alleviating the ongoing cost of living crisis. Notably, some arenas are facing over a 100% surge in business rates.

Government Response

In response to these concerns, a Treasury spokesperson acknowledged the potential for increased costs following the end of Covid support measures. However, they pointed to a £4.3 billion support package aimed at capping bills and maintaining a corporate tax rate at 25%, the lowest among G7 nations. The spokesperson also highlighted initiatives like relaxing temporary admission rules for gig equipment and providing tax reliefs for orchestras.

Impacts on Other Sectors

This warning from the live music industry follows similar alerts from small retail and hospitality businesses, which are grappling with the implications of the same tax changes. The future viability of these sectors remains uncertain, as the average pub is expected to pay an additional £12,900 in business rates over the next three years, according to industry analysis.

Context & Previous Events

The chancellor’s budget changes represent a significant shift in tax policy, with an emphasis placed on larger commercial entities at the expense of smaller establishments. As venues across the UK brace for what may become a pivotal moment in the sector’s history, the call for reevaluation echoes loudly, emphasizing the urgent need to protect cultural ecosystems critical to community life.